placer county sales tax 2020

These buyers bid for an interest rate on the taxes owed and the right to collect. The median property tax in Placer County California is 3441 per year for a home worth the median value of 427600.

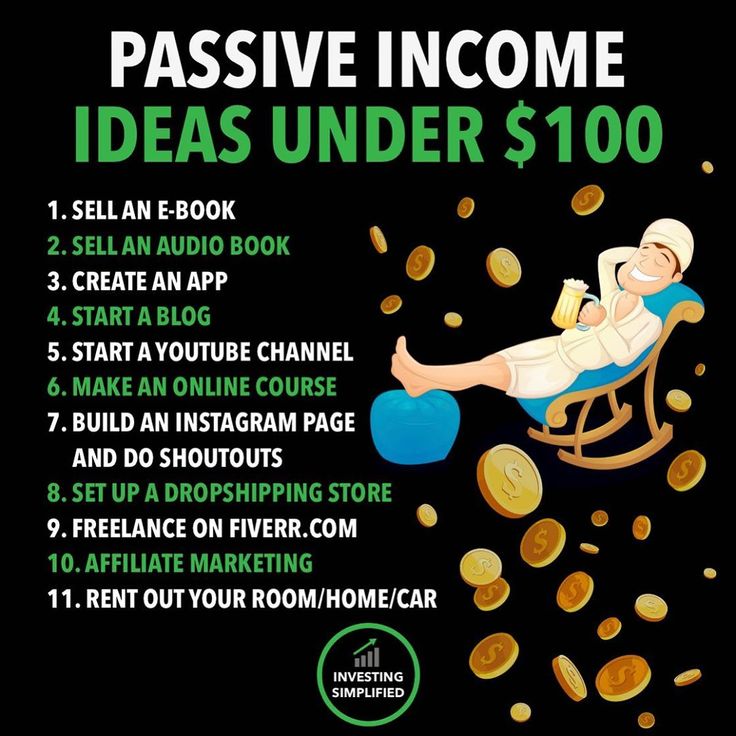

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

Property Tax Bills.

. Aptos 9000 Santa Cruz Arbuckle. Property Tax Bill Questions Answers. Roseville CA Sales Tax Rate.

The 725 sales tax rate in Lincoln consists of 6 California state sales tax 025 Placer County sales tax and 1 Special tax. Next to city indicates incorporated city. Auburn California Measure S Sales Tax November 2020 Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020.

The main increment is the state-imposed basic sales tax rate. All sales require full payment which includes the transfer tax and recording fee. Arcadia 10250 Los Angeles.

This table shows the total sales tax rates for all cities and towns in Placer. Retailers typically pass this tax along to buyers. You can print a 725 sales tax table here.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. The December 2020 total local sales tax rate was also 7750.

The California state sales tax rate is currently 6. It was defeated. The Placer County sales tax rate is 025.

This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. Retailers are taxed for the opportunity to sell tangible items in California. December 20 2021 properties postponed from the October 5th 2021 Tax Land Sale.

Appeal your property tax bill penalty fees and validity of assessment date. No personal checks will be accepted. The base sales tax rate of 725 consists of several components.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. The average sales tax rate in California is 8551.

Although the percentage is relatively small Placer County collected 305 million in sales tax last year. In an April presentation on changing sales tax projections county experts estimated 226 of the tax went to the public safety fund 22 went to Health and Human Services and 96 went to the Fire Fund. Published April 28 2020.

The December 2020 total local sales tax rate was also 7250. The total sales tax rate in any given location can be broken down into state county city and special district rates. Registration begins at 9 am.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. There is no applicable city tax. And the sale begins at 10 am.

Planning Commission Hearing Room. Community Resource Development Center. The minimum combined 2022 sales tax rate for Placer County California is 725.

The December 2020 total local sales tax rate was also 7250. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative January 1 2022 includes state county local and district taxes ALAMEDA COUNTY 1025. Look up the current sales and use tax rate by address.

Exceptions include services most groceries and medicine. Check out popular questions and answers regarding property taxes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Placer County CA at tax lien auctions or online distressed asset sales.

The Placer County Board of Supervisors has approved a comprehensive expenditure plan identifying which major transportation and traffic improvements are proposed for funding in South Placer should voters decide to pass a ballot measure that would increase the sales tax by a half cent. The December 2020 total local sales tax rate was also 7250. The sales tax is assessed as a percentage of the price.

Rates Effective 07012020. This story was originally published November 3 2020 11. The Placer County California sales tax is 725 the same as the California state sales tax.

Placer County collects on average 08 of a propertys assessed fair market value as property tax. City of Alameda 1075 City of Albany 1075 City of Emeryville 1050 City of Hayward 1075 City of Newark 1075. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes.

A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services including law enforcement fire services and code enforcement. The current total local sales tax rate in Roseville CA is 7750. Placer County has one of the highest median property taxes in the United States and is ranked 117th of the 3143 counties in order of median property taxes.

Find different option for paying your property taxes. The citys overall sales tax rate would be increased to 825 until 2028 and officials estimate it would bring in 256 million annually. California City and County Sales and Use Tax Rates.

What is the sales tax rate in Placer County. 3091 County Center Dr Auburn CA. This is the total of state and county sales tax rates.

Leaders said they are about nine years. The current total local sales tax rate in Placer County CA is 7250. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Estimate your supplemental tax with Placer County. List of Parcels Subject to Tax Sale In December 2021. California City and County Sales and Use Tax Rates Rates Effective 07012020 through 09302020 1 Page Note.

Placer County CA Sales Tax Rate. For tax rates in other cities see California sales taxes by city and county. Placer County CA currently has 351 tax liens available as of February 9.

All cashiers checks must be made payable to the Placer County Tax Collector. The current total local sales tax rate in Auburn CA is 7250. While large parts of it have seen recent updates the work is far from done.

Placer County could vote on half-cent sales tax for Highway 65 improvements. Method to calculate Placer County sales tax in 2021.

Food And Sales Tax 2020 In California Heather

Finoledge Money Management Advice Finance Investing Business Money

Auburn S Economy Continues To Bounce Back Sales Tax For Second Quarter Up 37 Gold Country Media

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money

Click The Photo For More Info And Free Real Estate Scripts Money Management Advice Finance Investing Investing

Property Tax Overview Placer County Ca

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

Use Your Tax Refund To Buy Your Dream Home Tax Refund Investing Tax Return