why are reits tax efficient

The income generated by REITs is not taxed on the corporate level and is. Tax rates on dividend distributions from the REIT.

Ashok Mohanani Chairman Ekta World Mumbai News Quikrhomes 4 Words New World Word Search Puzzle

That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings.

. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. R eal estate investment trusts REITs have faced headwinds of late. 5 Reasons Why Every Investor Should Own REITs.

Over the past two years the Dow Jones US. Because the REITs as a company are barely taxed on their earnings. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties.

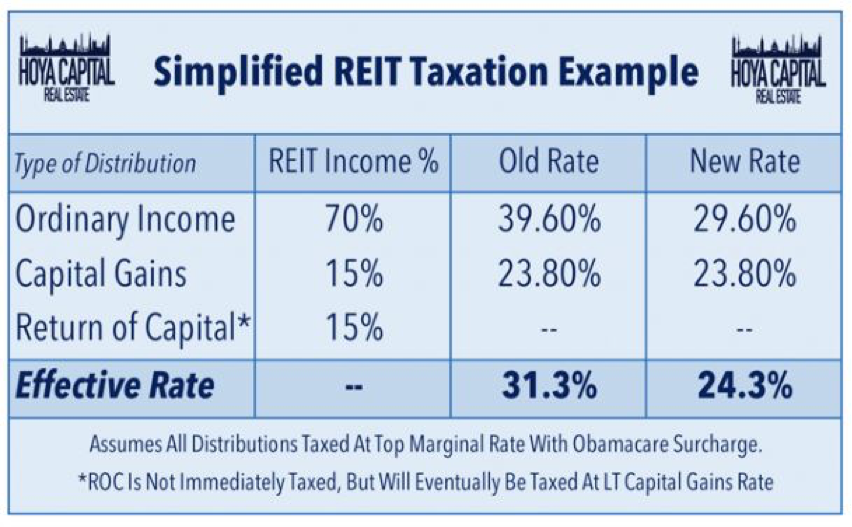

REIT returns tend to. REITs pay out roughly 65 of their distributions as ordinary income. Investing in a REIT is an easy way for you to add real estate to.

This company is required by law to distribute 90 of its taxable income to shareholders. There are two reasons for this. REITs Are Very Democratic Because REITs are required to constantly pay out their profits as dividends they generally have.

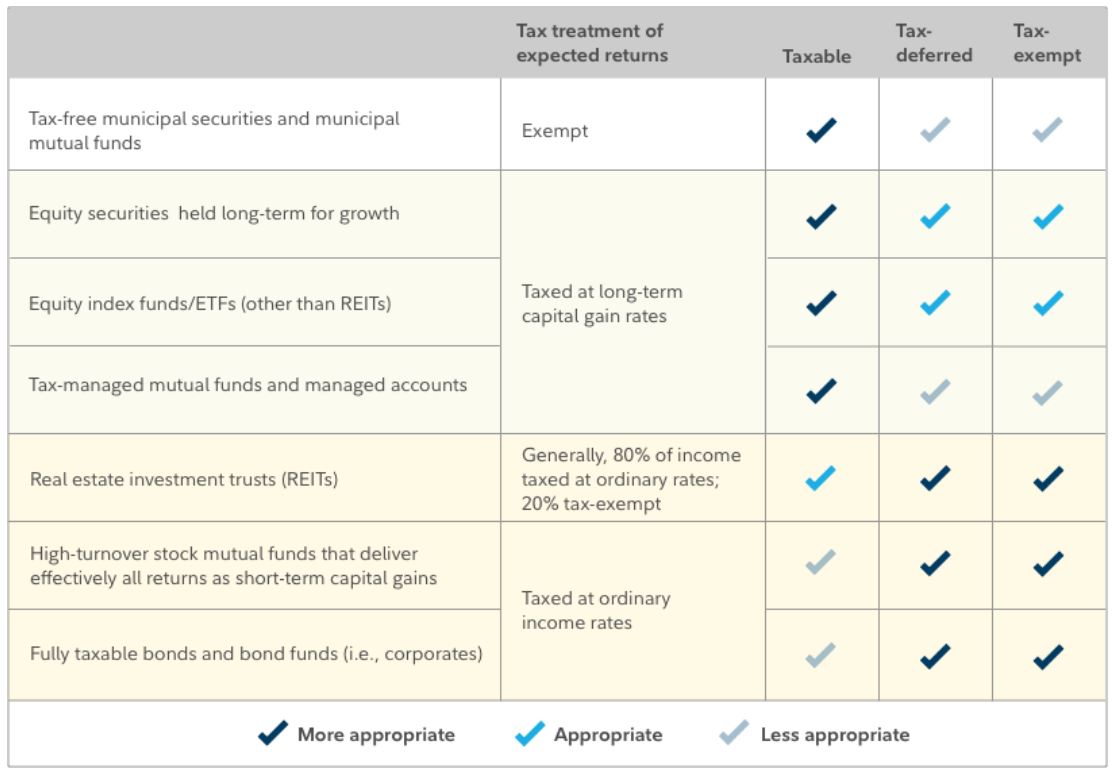

Shareholders may then enjoy preferential US. The remaining 35 is taxed at advantaged rates including 15 that is tax-deferred. As a result of avoiding this implicit double taxation a REIT is able to pass along more income to investors which may translate to higher take-home returns.

REIT taxation is a special case. In exchange for meeting certain requirements -- in particular paying at least 90 of their taxable income to shareholders as dividends -- REITs. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends.

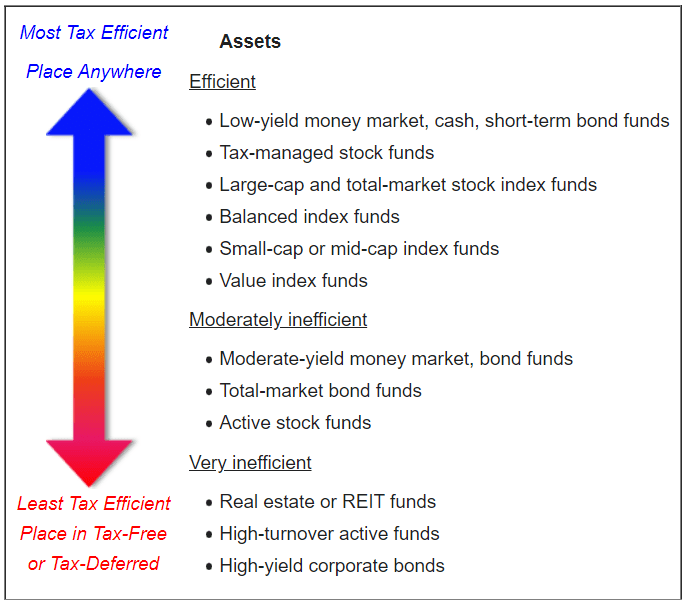

Get your free copy of The Definitive Guide to Retirement Income. REITs are known for their tax efficiency potentially helping investors take home as much of their earnings as possible. REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO corporate taxes so there is no double.

Heres the math for such a taxpayer. REITs avoid corporate-level income tax via deductions for dividends paid to shareholders. It is certainly a reason to invest in Reits through various tax wrappers but at this stage another.

Ad Each of these 3 companies pays around 10 to its shareholders annually. Taxpayers may also generally deduct 20 of the combined. Compared with mutual funds ETFs are light years ahead in these two critical categories.

Tax advantage of REITs Entities qualifying for REIT status under the tax code receive preferential tax treatment. Many investment advisors completely. But REITs kick the advantages up a notch.

Get your free copy of The Definitive Guide to Retirement Income. Select REIT Index has underperformed the SP 500 by nearly 35. One is that you lose the money you pay in taxes.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Two of the great underappreciated advantages of ETFs are their transparency and tax efficiency. REITs and Tax Efficiency In general REITs are less effective than other dividend stocks in a taxable portfolio because their payouts represent a large portion of returns.

Take that income through a tax-efficient pension or tax wrapper and the benefits become clear. The relatively low correlation of listed REIT stock returns with the returns of other equities and fixed-income investments also makes REITs a good portfolio diversifier. A REIT or real estate investment trust is a company that owns operates or finances real estate.

Normally an extremely tax efficient company will be an. It can be a way for you to invest less capital so that in 5 10 or 15 years. This 20 pass-through deduction reduces the top tax rate on REIT dividends from 396 to 296 for a taxpayer in the highest tax bracket.

The other is that you lose the growth that money could have generated if it were still invested.

Reits 101 Do You Know The Risk And Benefit Of Reits Investing Money Management Books Investing Strategy

Best Tax Efficient Funds Seeking Alpha

Tax Efficient Investing Guide Tips Account Types Seeking Alpha

Rental Properties For Passive Income 5 Things I Wish I Would Have Known Fir Real Estate Investing Rental Property Real Estate Education Real Estate Investing

Reits Vs Real Estate Mutual Funds What S The Difference

According To Case Shiller Us Housing Has Paused On Its Way Down Marketing Set Housing Market Marketing

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

Personal Equity And Retirement Account P E R A In The Philippines Retirement Accounts Equity Retirement

How To Get Ready For The Next Bear Market This Retirement Life Bear Market Retirement Portfolio Retirement

Investing For Beginners How I Got Started With No Money Broke As A Joke Youtube Investing Jokes Blog Marketing

Guide To Reits Reit Tax Advantages More

Best Tax Efficient Funds Seeking Alpha

Reits Or Rental Property All Season Financial

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

Guide To Reits Reit Tax Advantages More

Pin On Financial Planning Tips

Reminder You Are Shockingly Terrible At Investing Investing Investment Portfolio Investors

Where Tax Smart Investors Typically Place Their Investments Investing Finance Investing Accounting