portability of estate tax exemption 2020

A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december 31. A federal estate tax is imposed only on that portion of the estates value that exceeds the exemption amount said Shirley Whitenack an estate planning attorney with Schenck Price.

Irs Announces Higher Estate And Gift Tax Limits For 2020

This exemption stayed in place for.

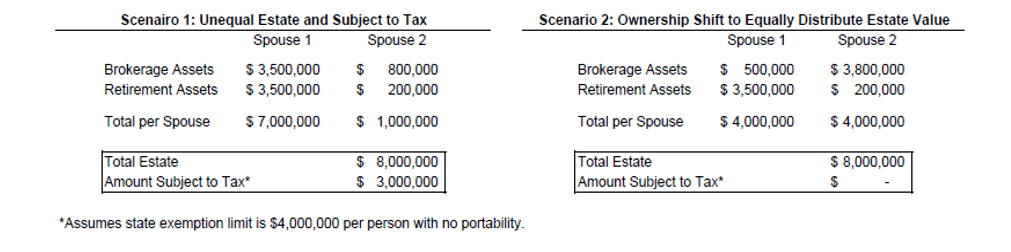

. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The key advantage of portability is flexibility. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for.

Had she filed for portability when the higher estate tax exemption enacted into law under President Trump then the 5 million taxable estate would have been reduced by the. The non-exempted amount of 545 million would be portable and would be passed to his wife. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax.

The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. You are eligible for a property tax deduction or a property tax credit only if. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. This exemption does not entitle any person to a refund of any tax heretofore paid on the transfer of property of the nature. Being a legal New Jersey resident.

To qualify for the 100 disabled veteran property tax exemption you need to meet the following requirements. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The exemption is in fact indexed annually for inflation so it does increase over time.

The wife has to file the IRS Form 706 federal estate tax returns to get the portability within. 2022-32 may seek relief under Regulations section. The exemption is subtracted from the value.

Portability Of Estate Tax Exemption 2020. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. Learn More at AARP.

Back to the example above and assuming the current federal gift and estate tax exemption is in fact reduced by half in 2026 if portability is elected and the surviving spouse. For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can. Portability Of Estate Tax Exemption 2020.

6 Often Overlooked Tax Breaks You Dont Want to Miss. A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december 31. As of 2021 the federal estate tax exemption is 114 million.

The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount. The Illinois estate tax on an estate of 16880000 would be 1524400. When Mark dies in 2020 he is able to take advantage of the estate portability rules which means he gets the federal tax exemption that Joan didnt use 114 million plus his.

Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. Owning and occupying your property as your. Estate or estates is exempt from the New Jersey Inheritance Tax.

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

Usda Ers Less Than 1 Percent Of Farm Estates Owed Federal Estate Taxes In 2020

Is It Too Late To Elect Portability Burner Law Group

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

Portability A New Irs Rule Kling Law Offices

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

How To Minimize The Voluntary Federal Estate Tax With Portability Rincker Law

Tax Related Estate Planning Lee Kiefer Park

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

Estate Tax In The United States Wikipedia

Exploring The Estate Tax Part 1 Journal Of Accountancy

Newly Enhanced Estate Tax Portability Relief Under Revenue Procedure 2022 32 Tax Trusts Estates Law